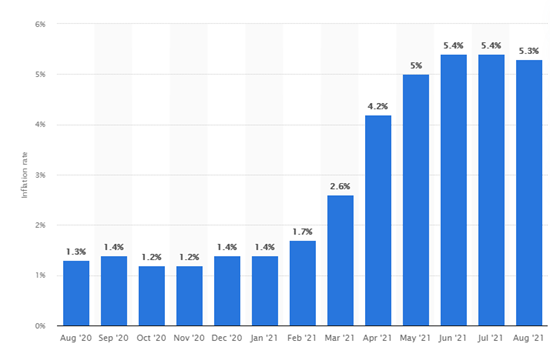

Prices increased by 5.3% from August 2020 through August 2021 according to Statista. This is the highest inflation rate since 1990.

Monthly 12-month inflation rate in the U.S. August ’20 – August ’21; Source: Statista

The ongoing discussion on rising inflation has many investors questioning what they can do to protect their money. Luckily, multifamily real estate is one of the best investment opportunities during an inflationary period. Multifamily outperforms many other investments during times of inflation; here are a few reasons why:

- Shorter Leases

Multifamily leases are typically much shorter than commercial leases. For example, while a hospital may sign a 20- or 30-year lease, an apartment resident will likely sign for one year or less. These shorter leases provide the opportunity to increase rents much quicker than a commercial property, allowing multifamily properties to take advantage of inflation.

- Single-Family Home Prices Increase

During high inflationary periods, it can be more difficult to purchase a home. Home prices have increased by over 13% since 2020, according to Zillow. An increase in home prices is likely to deter many first-time home buyers, resulting in a continuation of renting. Additionally, interest rates often increase during inflationary periods.

- Rise in Value

Real estate values tend to rise during periods of inflation. Because real estate is a leveraged asset, the value will continue to grow over time.

- Cash Flow

Lastly, multifamily investing is a steady investment during inflationary periods, as people always need a place to live. Regardless of inflation, rent will be paid.

These reasons illustrate how investing in multifamily is a great hedge against inflation. If you have any questions about investing in multifamily real estate, visit our website at metonic.net, or email us at info@metonic.net.