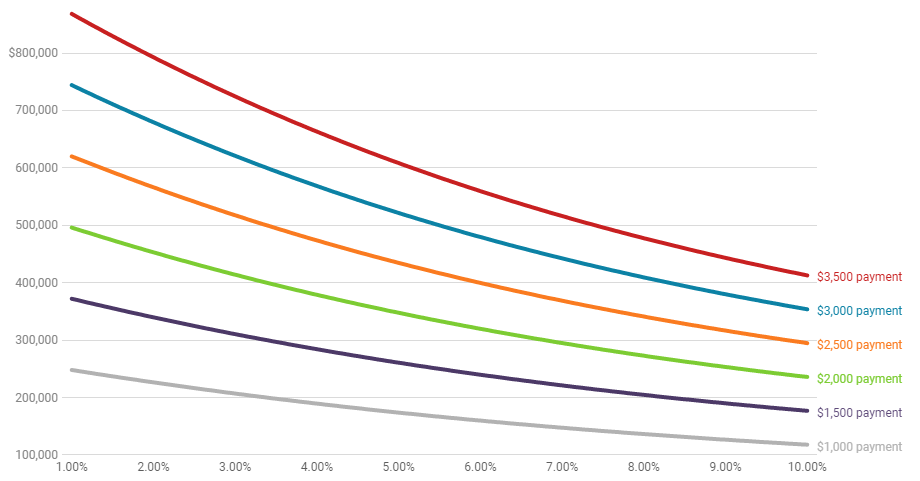

Surging inflation, record-breaking housing demand, significant interest rate jumps, and ever-present student loan debt. These all contribute to the question – can millennials afford to own? A recent report shows that 36% of higher earners in 2022 live paycheck to paycheck, doubling what was reported in 2019. In Q1 2022, the median sales price of homes in the US reached a record high of $428,000, according to Zillow, up over 14% from the same time last year. According to another study, homeownership for millennials is 8% lower than in 2000. Rapidly increasing interest rates are another pitfall for potential homebuyers. According to Redfin, at the end of last year, a homebuyer with a monthly mortgage budget of $2,500 could afford a home worth up to $517,500. Today (June 2022), that same homebuyer could only afford a home worth up to $399,750, a $120,000 drop in purchasing power. The chart below shows how much one can afford with various monthly payments based on the interest rate. This assumes a 20% down with a 30-year mortgage at a 1.25% property tax rate.  Source: Redfin

Source: Redfin

While unfortunate, these economic conditions prove multifamily real estate’s resiliency. Millennials will continue to opt for renting rather than owning as interest rates continue to rise. The demand for mortgage-free living is apparent, and Metonic is proud to provide it. In the past two years, we have added over 300 units to Omaha’s multifamily inventory, are currently under construction on an additional 175, and have over 500 in our pipeline for 2022. To learn more about Metonic and our development process, visit Metonic.net or email us at info@metonic.net.