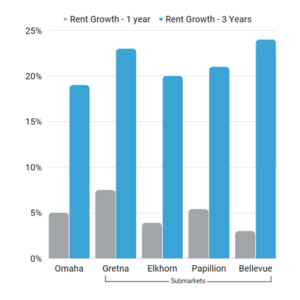

According to CoStar, The Omaha multifamily rental market continues to demonstrate its strength, with average rent around $1,150/month, a 5.0% increase from the prior year. Omaha rents have increased by a cumulative 18.5% in the past three years.

Omaha submarkets have seen even more growth. The Gretna submarket saw a rent increase of 7.5% compared to last year, and 23% cumulatively over the past three years. The Elkhorn submarket’s rents increased by 3.9% since Q322, and 20% cumulatively over the past three years. In Bellevue, a 3% increase, and in Papillion La Vista, a 5.4% increase, 24% and 21% cumulatively over the past three years, respectively.

Omaha has also experienced continued employment and population growth in the past year, with jobs up 2.1% and population increasing by 0.9%. While some markets nationally have begun to soften relative to historically high post-pandemic rent growth and vacancy rates, Omaha has continued to show resilience and remains an attractive market for investors.

Metonic is proud to have 40 apartment communities containing nearly 4,000 apartment homes in the Omaha market. To learn more about investing in the Omaha multifamily market, visit us at Metonic.net or email us at info@metonic.net.