Omaha was named the top market for emerging multifamily markets in 2024, according to Multi-Housing News. The report uses Yardi Matrix Data and considers several factors, including economic activity, employment rate, and apartment demand.

Despite being the third most populous metro on the list, Omaha has demonstrated remarkable performance across various metrics. With 4,506 units delivered in 2023, Omaha boasts the second-largest volume of new construction among its peers.

Occupancy rates remain tight at 96.0 percent as of November, indicating sustained demand for apartments in the region. Economic activity in Omaha has been moderate, with employment expanding by 1.5 percent in the 12 months ending in October. Notably, the city boasts the tightest job market among the analyzed metros, with an unemployment rate of 2.5 percent in November—well below the national average.

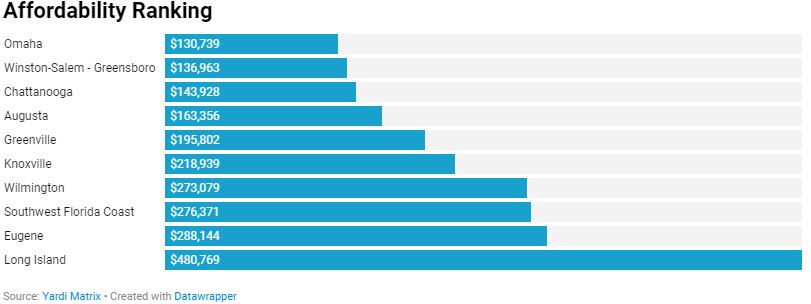

Omaha stands out as one of the most affordable multifamily markets nationally, with an average price per unit of $130,739 as of December—a 15.4% increase year-over-year. Investors traded approximately $275 million in multifamily assets in Omaha in 2023, underscoring the city’s attractiveness as an investment destination.

As investors navigate the dynamic landscape of the multifamily market in 2024, emerging markets like Omaha present compelling prospects for long-term growth and profitability. With robust demand, favorable economic indicators, and attractive affordability, Omaha exemplifies the potential for success in the multifamily real estate sector.

Metonic is proud to have 30 Omaha properties in our multifamily portfolio, totaling over 4,000 apartment homes. To learn more about Metonic and our acquisition and development strategies, visit our website at metonic.net.