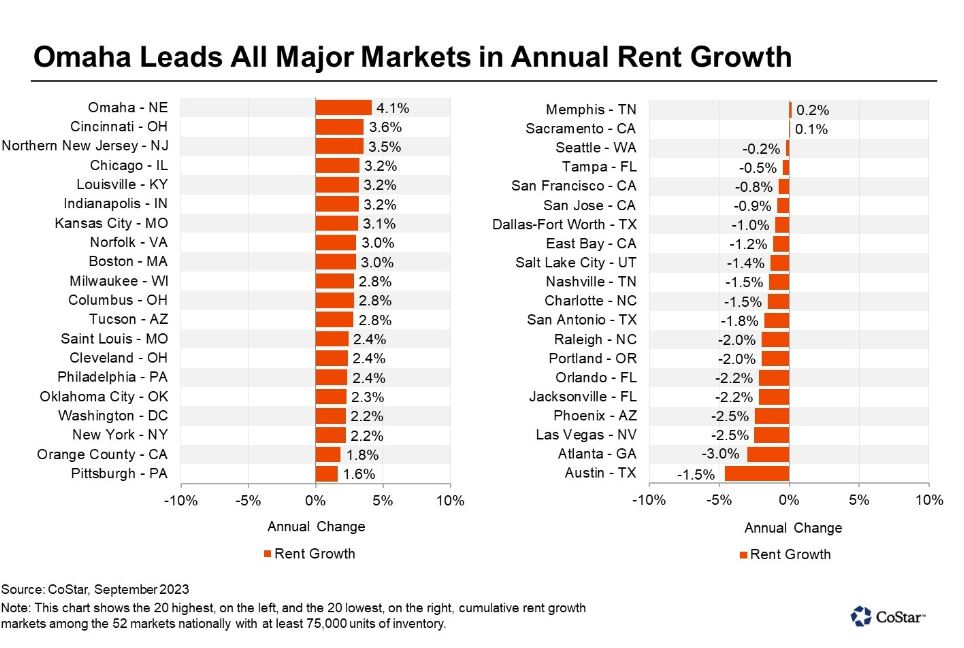

Omaha Leads Major Markets in Rent Growth

Omaha has emerged as the frontrunner in rent growth among major U.S. markets, as reported in a September article by CoStar. Following a 7.3% increase in Q1 and a 4.9% rise in Q2, the annual rent growth for Q3 is now at 4.1%.

Omaha’s success can be attributed to its stable rental market and a diverse economy, which has led to steady demand for housing. Unlike many other cities where rental affordability is a challenge, Omaha’s multifamily market benefits from a lack of affordable options in the single-family housing market, making multifamily renting a more attractive choice for many residents. Additionally, the construction of more affordable housing in growing suburban areas has balanced the supply and demand, leading to strong rent growth across various types of apartments and locations in the region.

Despite a temporary slowdown in rent growth due to supply-side factors, such as reduced construction starts, experts predict that Omaha’s rental market will pick up again in 2025. Even with this slowdown, the average annual rent gains in 2023 and 2024 are still significantly higher than the pre-pandemic years, indicating the city’s robust rental market.

Metonic is proud to have 40 apartment communities containing nearly 4,000 apartment homes in the Omaha market. To learn more about investing in the Omaha multifamily market, visit Metonic.net or email us at info@metonic.net.