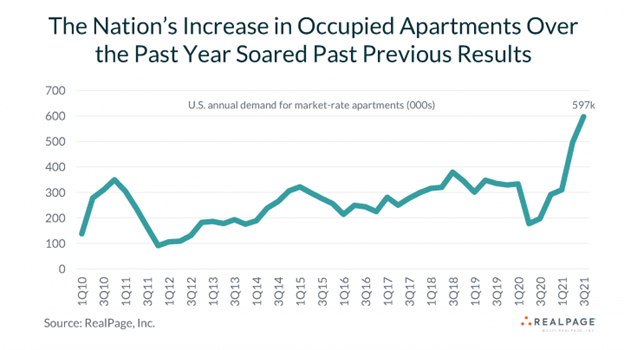

Demand for apartments reached a record high in Q3 2021, according to RealPage, Inc. Their research showed that the nation’s occupied apartment count jumped by over 255,000 units from July to September of this year, the largest quarterly increase the U.S. has seen since the ‘90s. The annual demand at the end of Q3 was nearly 600,000 units, soaring past 2018’s peak of 380,000.

The record-breaking demand for multifamily apartments is largely attributed to the residential housing market. Increased home prices and limited inventory are moving some would-be buyers into renting. Additionally, many sellers are now temporarily renting again. The increase in apartment demand also stems from many recent graduates and young workers who had moved in with family at the start of the pandemic.

The Midwest, more specifically, continues to be a top region for multifamily investing. Smaller markets like Springfield and Lincoln are proving to be leaders in the region. RealPage research shows consistent demand and growing asking rents in these markets, both of which are outpacing national levels.

At Metonic, we utilize our Midwest market knowledge to target properties that provide strong, risk-adjusted returns and maintain lower than average volatility. To learn more about Metonic’s investment strategy, visit our website at Metonic.net or email us at info@metonic.net.